When I started trading years ago, the first system I was introduced to was a very simple strategy that involved Fibonacci. Unfortunately, the Trading system was so simple that it lost money on a consistent basis! But as I continued to evolve and develop from those humble beginnings, I never did stray very far from my Fibs. Along the way, however, I have discovered an alternative use of Fibonacci levels that is incredibly effective. If you currently use Fibs, there is a strong possibility you are only using them at about a 50% rate of efficiency.

Traditional Fib Execution

When I first began using Fibs on a consistent basis, I used them the way that most people do. You identify a swing HI and a swing LO on a chart if price is moving down (reverse in a bullish market), then you draw the Fib tool from the HI to the LO, and Fibonacci retracement levels are automatically populated on your chart. The chart directly below depicts a very clear swing HI and swing LO.

Fibonacci Strategy

The second step is to simply draw your Fibs from the Swing LO to the Swing HI.

Best Fibonacci Strategy

Once you draw the Fibs from Swing LO to Swing HI, your fib levels automatically populate. Now, Fibonacci trading theory states that when price makes an impulsive move from a Swing LO to a Swing HI, it will typically retrace 23%, 38%, 50%, 62%, or 76% of the move before it breaks the Swing HI and continues the move up. A Fib trader is now looking to enter a long position as price pulls back to one of these Fib levels.

In this example above, simply buying EUR/USD at every Fib level is going to be an ineffective strategy. Most Fib traders will use the Fib levels as guides and then look for additional price action confirmation in order to actually enter a trade. Personally, I like to combine heavy areas of support/resistance with my understanding of order flow in order to identify Fib levels that have a high probability of providing enough support to actually bring substantial demand into the market and push price back to the upside.

Let’s see how these Fib levels from the chart above actually held up.

Fibinacci Strategy That Works

As you can see price did bounce nicely off the 38%, 50%, and 76% Fib levels. However, price did not slow down at all at the 23% and the 62%. Long positions off those two Fib levels would have surely been stopped out. Now, a trader can definitely develop an effective trading approach that is centered around buying at Fib retracements in a bullish market or selling at Fib retracements in a bearish market, but I believe that this traditional approach to Fibonacci trading is only partially effective. There is a whole lot more to understand!!

The Backstory

Several years ago, I was talking on the phone with another professional trader who had been very successful in the Forex market. In passing, he mentioned that he loved to trade off the backside of Fibonacci levels. As a Fib enthusiast, this caught my attention. I had never considered trading off the backside of the fibs. Immediately, I went to the charts and began looking at historical price action, and sure enough I began to notice that price was consistently bouncing off the backside of previously broken Fib levels. Today, trading retests of the backside of previously broken Fibonacci levels is one of my favorite price action setups I use to enter positions in the market.

The Backside of the Fibs

Let’s continue with the same EUR/USD example we used in the previous chart pics.

Retracement Strategy

Price retraced all the way down to the 76% retracement before it began rising back to the upside. Notice what happened when price rose to the backside of previously broken Fib levels! First, price raced up to the backside of the 62%. Very little resistance was brought into the market and price continued to rise, but notice what happened as it came to the backside of the 50%. Strong resistance resulted in a near 100 pip reversal. Then, when we finally break through the 50% and move up to the backside of the 38%, price finds strong resistance again and reverses nearly 100 pips.

Probability Theory

Forex Trading is a game of probability. You never win every time. Instead, you develop a strategy and risk model that is designed to produce a positive outcome over a large sample of trades. Therefore, it is always a good idea to research your trading ideas in order to develop parameters and filters that help optimize your Forex strategy. During my research phase of this particular setup, I noticed that Stochastics acted as a very effective filter.

Stochastics and Backside of the Fibs

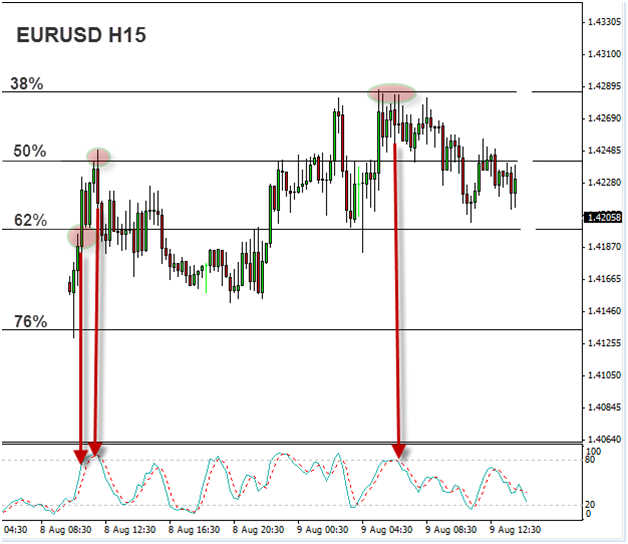

Stochastics Strategy

Now, when I identify a backside of the Fib setup, I go to the 15 Minute chart and look at Stochastics (setting: 8,3 ,3). I prefer for Stochastics to confirm an overbought or oversold condition. In the example above, remember the backside of the 62% did not provide resistance. Price broke straight through it. But notice that Stochastics were still wide open and pointing up. Typically, it is not a great idea to sell when Stochs look like that. If you had waited, in this example, for Stochs to hook and cross, you would not have entered until price broke up to the next Fib level, which was the backside of the 50%. And sure enough, you can see that once Stochs hooked and crossed, and price hit the backside of the 50%, price reversed over 100 pips.

Conclusion By utilizing this new approach to Fibonacci trading, you are essentially increasing your efficiency rating by 50%! Remember to always conduct your own exhaustive testing and research of a trading idea before using it in your own trading, and remember there is always the risk of loss. No trading setup will work 100% of the time.