Using the Black Mamba as a Sidekick

The words “Black Mamba” may be bring one of two images to your mind. First, if you are a basketball fan, it brings to mind the ferociously talented Kobe Bryant, as he is nicknamed the Black Mamba. Second, it may bring to mind an image of the most deadly snake in Africa. Although I do love basketball, and consider Kobe Bryant to be one of the All-Time Greats, this FX Strategy is so named because it shares some key characteristics with the Black Mamba, Africa’s most deadly snake.

The Black Mamba is a poisonous snake in Africa that hunts its prey by hiding and waiting for it to get within striking distance. When its unknowing prey falls within striking distance, the Black Mamba goes to work. This is exactly how we pursue our trade set-ups as traders of the Black Mamba Strategy.

Let’s get to it. Currency pairs do not move an infinite amount of pips per day. In fact, they actually move in a rather predictable pattern. Under normal market conditions, the EUR/USD generally moves about 130 pips. That can increase or decrease depending on certain fundamental drivers, but for the most case, the E/U will generally move that amount.

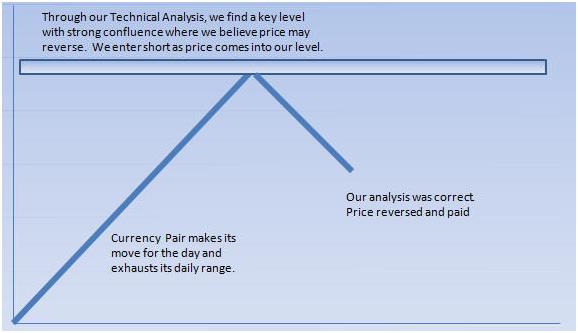

The aim of this trading strategy is to locate the zone where a currency pair will be exhausting its daily range and then determine whether there are any key levels in those areas that may offer us a high probability reversal point.

Stealth Trading Style

Technically, this is considered a contrarian market approach, since you will be fading market momentum. It is also termed a “reversion to mean” strategy, which statistically is a strategy that is profitable over the long term.

The preparation for this strategy ideally takes place each night between 7-8 pm. At 7 pm est, you want to look at price and measure X amount of pips in each direction, with X being your daily range. I like to calculate the daily range by taking the average over the previous 10 trading days. This will help you stay in alignment with current market conditions instead of simply sticking to a fixed number which could change over time as market conditions change. To find the average, you can either program it in any of the various trading platforms that have learn-able programming language, or you can do it by hand. Mark 7 pm est on your chart for each of the previous 10 trading days and determine how many pips that pair moved each day. Then take the total divided by 10, and voila you have your daily range.

Let’s assume the range is 150 pips for the pair you are looking at. Sometime during the Asian session, draw a horizontal line 150 pips in each direction from the opening price at 7 pm. These 2 lines are the zones where you will now look for a key level of reversal.

The reason I take 7 pm est is because that is the beginning of the new day in London, and London times are what the majority of traders around the world are looking at. Here is an example below.

Black Mamba Forex Trading Strategy

Now, you are going to look for key levels within or close to those red boxes where price may offer a reversal.