Forex Trading System

Developing a new Forex Trading System can take days, weeks, months or even years. Forex traders are always looking for the holy grail, but in the end it is up to you when it comes to trading. You are looking for an edge in the market and finding one can be quite difficult. As you know by now, we trade many different methods. We’ll be using our wick method using our Wick histogram indicator developed by “TRO”. This indicator made trading this method a lot easier and saves a lot of time.

We call this strategy the Wickity Whack Method or WWM for short. It follows price action during the day and can be traded at most times. Obviously certain times are better than others. This method can be used with any pair, but we’ve only tested it with the EURUSD.

There are a few reasons why we only use the EU:

The spread is usually low compared to other currency pairs which is important when scalping.

Movements are strong.

Wicks occur often enough so more trades are taken throughout the day.

The strategy is fairly simple in terms of what to do. The hardest part, is executing quickly enough in case you are not watching the market at the moment. The first thing you want to do is setup a five minute candle stick chart of the eurusd. We highly recommend you use the Metatrader platform for ease, not to mention that it is free. Multiple brokers offer this platform as a retail trading tool. All the brokers listed on this site have a Metatrader platform.

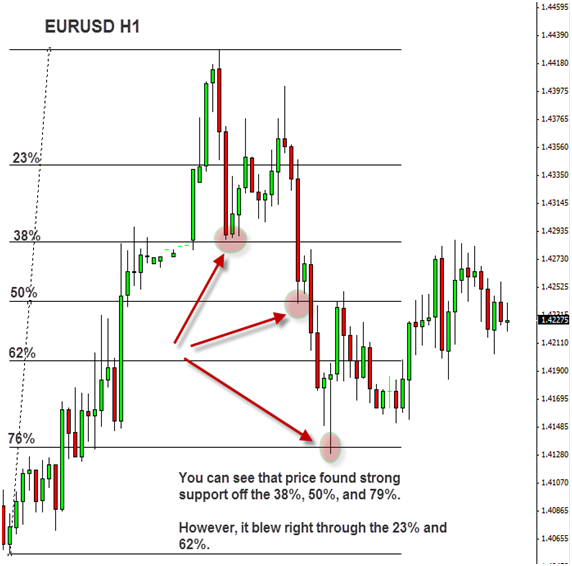

Once your candlestick chart is setup, whether you have the wick histogram indicator or not, all you’re looking for are 5 minute candles with wicks that are 10 pips or longer. If you see a wick that has a 10+ pip wick, then on the next candle you want to trade the reverse of the wick. Say the price is moving up and the wick forms pointing up. Then on the next five minute bar you will go short. You can either enter immediately or you can wait, giving the current candle some wiggle room to retrace toward the wick and then go short. Of course everything is the same for going long with the wick pointing the other direction.

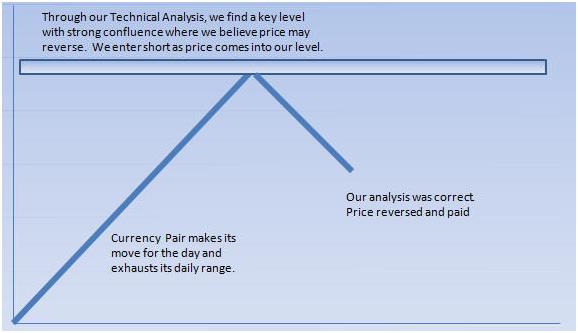

Your goal is too scalp 5 pips or more. You can set a limit for this or you can use single click market orders to exit. Another method is to set a limit on half your position at 5 pips and then move your stop down to break even once the 5 pips is hit, so you can go after bigger profits. Sometimes you will only get as much as 5 pips, other times you can get dozens of pips. This is something you will need to test and demo, so you can get a better feel of how the WWM system works. Reminder: Don’t be greedy and let the Forex scalping work for you.

Should the trade go against you, you’ll have a stop loss, 2-5 pips away from the tip of the original wick you are trading against. The most you should place a stop for is 20 pips. If the original wick is over 15 pips, you should let the next candle retrace up the wick before entering. This gets you in a safer trade with less risk, but you may miss out on several good plays. Keep in mind anything can happen when trading so you need to act fast.

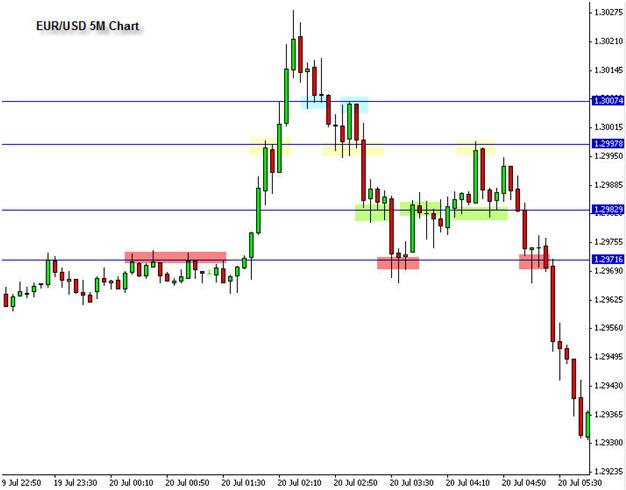

Here is a perfect setup for the WWM method:

Forex Scalping the WWM – You enter short at 1.3212 and it had 25 pip profit potential.

Going forward we will keep this page updated with some of our latest WWM trades. We will also include some live trade on Video.

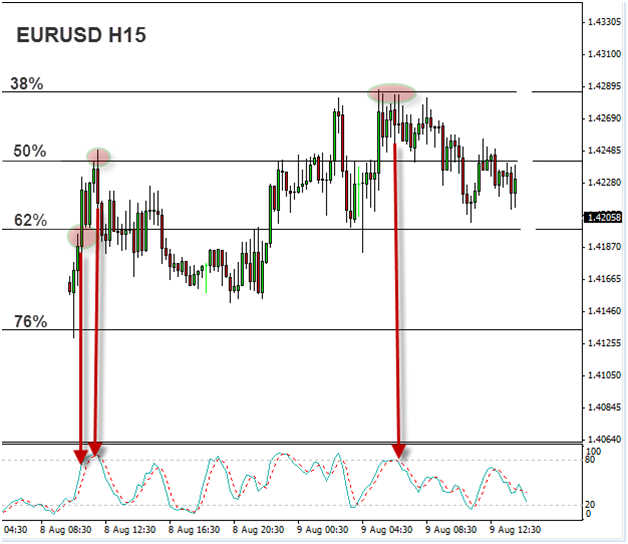

Here is a perfect trading session trading the wicks. You multiple opportunities to make trades, some were average size, but a couple of them had a lot of big time potential, if you sold half and moved your stop.

Scalping wicks all night long makes you a lot of pips

If you were around this morning trading the WWM you had some nice gainers, plus an account doubler.Plenty of trades available. Only patience is required

1.16.2009

This is our first video about our wick trading method.

01.18.2009

Here is our latest video from the European trading session on Thrusday night into Friday morning.

01.19.2009

It’s not always the best to trade when there is a holiday. Here is a look at two trades that occurred Sunday night, so you wouldn’t even have to trade on Monday. In less than an hour you had pip profit potential of 70-80 pips on two trades.

Trading Before a Holiday

Developing your own strategy can be quite difficult. Make sure you cover all the main features of a trading plan and don’t fall in love with one strategy until you know it is favorable in a lot of markets.